Who needs a FT 4905BE form?

Any business entity, which want to make a compromise or make a specific agreement with govern entity.

What is for FT 4905BE?

FT 4905BE is a Booklet Offer in Compromise for Business Entities, which requires complete data about business, which offers compromise. Government has a requirement to side, which offers Compromises according this form. Some of them:

- Applicant have filed all tax returns.

- Offer in Compromise must be fully completed and all required there documents must be attached.

- Applicant agreed with Franchise Tax Board on the amount of tax.

- Investigation about credit history and financial activity will be made by FT.

Also, Booklet contains important information for applicant and hints how to file it correctly.

Is FT 4905BE accompanied by other forms?

FT 4905BE form usually requires to be attached collateral agreement. But not in all cases. Inside the form may be required specific reports about financial activity, tax payments and staff.

When is FT 4905BE due?

FT 4905BE expires after execution by govern entity.

How do I feel out FT 4905BE Order?

The following information must be mentioned in the FT 4905BE form:

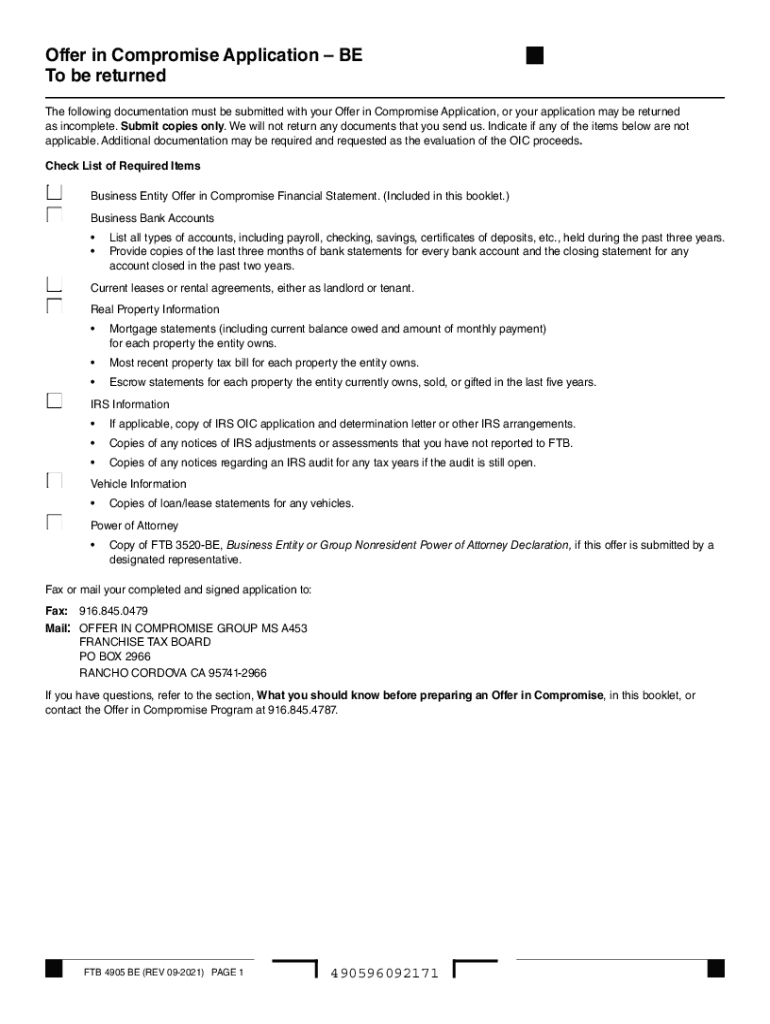

- Checklist of required items

- Basic information about business owner

- Amount owed

- Offer

- Source of funds

- Ownership

- Basis of the offer

- Business entity information

- List of Entity Officers/General Partners/Managing members

- Financial information

- Statements of assets and liabilities of entity

- Life insurance policies

- Accounts and notes

- Environment used in business

- References

- Statements of income

Where do I send FT 4905BE Order?

Completed form must be sent to Franchise Tax Board MSA453 PO BOX 2966 Rancho Cordova CA 95741-2966.